The wonderful thing about investing is that you don’t have to know people personally for them to be your mentors. A lot of great investors have written articles, letters and books that are publicly available. There are many ways to invest successfully, but it’s important to find an approach that makes sense to you.

Unlike the more “timely” weekly reading series, I intend for this page to become a library of “timeless” articles and resources that have been helpful to me in an investing context. Hopefully other people will also find them useful or, at the very least, interesting. I will add to this collection over time, so feel free to check back on occasion.

Note: apologies in advance for any broken links; if you are looking for a copy of any of the articles listed below, you may want to contact the author/organisation directly.

In no particular order:

Building a life

Howard Stevenson, professor emeritus at HBS and co-founder of the Baupost Group, shares some of his life lessons. Lots of practical insights and wisdom. For more, see his conversation with Sal Daher, covered previously on this blog, and his book Wealth and Families.

Talking your book

Patrick Luo’s research paper on the evidence from stock pitches at investment conferences.

Digital decolonization

David Halpert, founder of Prince Street Capital, on a new paradigm for assessing investments in emerging and frontier markets (transcript available here).

Musings of the market in gold stocks and what comes next

David Crichton-Watt, founder of AIMS Asset Management / Phoenix Gold Fund.

The life and death of Adolf Lundin

Institutional Investor’s final interview with the legendary natural resources entrepreneur.

Do stocks outperform treasury bills?

Research paper by Professor Hendrik Bessembinder of Arizona State University. The original study looked only at US stocks, but the scope was later expanded to include global stocks. Although not mentioned in the title, the paper is really about the positive return skewness of long-term stock market returns, which basically means that a few stocks have very large returns, while most have modest or negative returns. This is quite intuitive – the challenge for investors lies in being able to identify the winners (lots of hindsight bias at play here) and having the discipline to hold them for the long-term (not easy to do as your portfolio becomes more concentrated, especially if you are a fund manager).

Letter to a friend who may start a new investment platform

Written by Graham Duncan of East Rock Capital. Excellent read and well worth your time (especially for those who are thinking about starting a new venture). Also see his letter to a friend who just made a lot of money.

The trouble with optionality

Mihir Desai discusses how the emphasis on creating optionality can backfire in surprising ways. Instead of enabling young people to take on risks and make choices, acquiring options becomes habitual. You can never create enough option value – and the longer you spend acquiring options, the harder it is to stop.

Interview with Yen Liow

The founder of Aravt Global on his life philosophies, investing frameworks, some mentors he has had along the way, learning from difficult times and more.

Investing in Russia

Conversation with Mattias Westman, the founding partner at Prosperity Capital Management.

Live long & prosper

I’m a fan, albeit somewhat sporadic reader, of Gordo Byrn’s blog. I was initially only interested in the topics related to personal finance, but over time, his writings have helped me step back and think more holistically about the concept of wealth (e.g. control over your time, quality of relationships with family and friends, physical health). His e-book (which you can access or download for free from his blog) contains many valuable insights and frameworks that can be used in your own life.

Valuation fundamentals in Asia

Richard Lawrence of Overlook Investments discusses in detail the tools, disciplines, and procedures for financial analysis of Asian companies. Amongst other things, he covers cash flow, the evaluation of management, projections and valuation criteria. This has probably been the single most helpful resource for me as a private investor. I also highly recommend his 2015 talk at the Richard Ivey School of Business (link here).

The private equity approach to public equity investing

Stan Miranda and Brendan Corcoran of Partners Capital write that “success in active equities requires a long time horizon, a value bias, deep bottom-up fundamental analysis and contrarian investors who think like business owners rather than securities analysts.” What they are really talking about is a private equity-like approach to public investing.

The sons of Stanford

A look at the Stanford “outpost” of value investing that has evolved out of a series of graduate school courses taught by Professor Jack McDonald. Includes interviews with a number of former students who have gone on to become notable investors. The chapter is an excerpt from Andrew Kilpatrick’s Of Permanent Value.

Quantimentally PE

Dan Rasmussen’s Verdad Capital is focused on achieving private equity-like returns in the public markets. His presentation looks at the factors that explain private equity outperformance (size, value and leverage combined with debt paydown) and explains what we can learn from the numbers.

Lei Zhang’s lecture at CBS

The low-profile founder of Hillhouse Capital shares some of the investing and life lessons he has learnt since graduating from the Yale SOM. The notes are courtesy of Zong Z. Peng.

Reflections of a value investor in Africa

Francis Daniels, the co-founder of Africa Opportunity Partners, reflects on his personal investing journey and shares some lessons learnt from a career investing in the region. The presentation is a little dated but nonetheless makes for an excellent read. A short personal note: I had the great pleasure of meeting Francis over lunch a few years ago when I was based in Johannesburg. He was very generous with his time, insights and advice.

Changing institutional portfolio management

Transcript of a guest lecture by Professor David Swensen, Yale University’s Chief Investment Officer. He outlines the three major determinants of investment returns (asset allocation, market timing and security selection) and also discusses how the endowment selects active managers.

Art as an asset

An analysis of John Maynard Keynes’ art collection identifies general attributes of art portfolios crucial in explaining why investor returns can substantially diverge from market returns: transaction-specific risk, buyer heterogeneity, return skewness, and portfolio concentration.

Scott Adams on success

One of my favourite talks. The creator of Dilbert shares some key insights from his excellent book: How to Fail at Almost Everything and Still Win Big. His framework covers why goals are for losers, passion is overrated and how luck can be manipulated (sort of).

Kevin Kelly

68 bits of unsolicited advice.

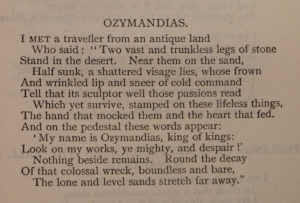

Ozymandias

Percy Shelley on the transience of power and accomplishment (below taken from the British Library).

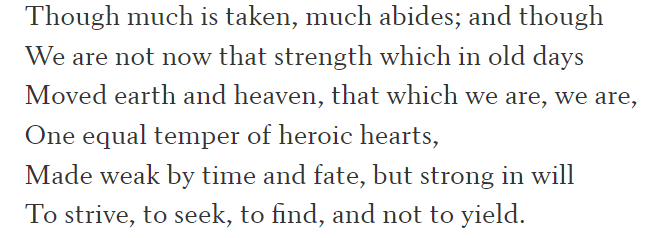

Ulysses

The final stanza from Lord Tennyson’s poem: