OAM Letter

Desmond Kinch’s annual letters for the Asian Recovery Fund are always worth a read. In this year’s letter, he discusses their thoughts on investing in China, the reason they have ~25% of the fund’s assets in India despite a significant tax drag and higher valuations vs. other markets in Asia, and why ASEAN markets are currently the fund’s biggest overweight relative to its benchmark. Below are a few excerpts/highlights:

- The fund currently has three single company investments in China and Hong Kong: China Yangtze Power, Swire Pacific and COSCO Shipping International. He has written about each of these names in previous letters (see our previous coverage here and here).

- On China Yangtze, he highlighted the recent asset injection of the Wudonde and Baihetan dams, which will increase the company’s generating capacity by ~60%. The deal outline terms indicate there should be a meaningful jump in China Yangtze’s free cash flow per share due to synergies and that equity dilution that will be a lot less than the resulting earnings accretion. Shares are trading at a 5.8% unlevered cap rate and 8.5% levered cap rate.

- In India, they have significant exposure to Bajaj Finance, a NBFC focused primarily on financing consumer durables. In recent years, the introduction of “Aadhaar and UPI have allowed the company to build a historical database of consumer cash flow and spending data that [he] thinks is unparalleled in the world. The company is using data analytics and its broad distribution reach to increase its customer base and sell them new services.” According to one of the managers they have invested with, the company’s earnings could quadruple between over the next 3 years, so although its shares look expensive based on trailing earnings, they look attractively valued if that earnings growth materializes.

Packer & Co. Letter

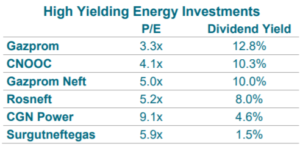

Traditional energy is now ~34% of the portfolio, with many of their holdings trading at dividend yields and P/E multiples that are extremely attractive. A recent addition to the portfolio is CNOOC, which is a 25% partner in the Guyana oil discoveries made by Hess and Exxon, the value of which is not adequately reflected in the current valuation. Besides oil & gas, they also like nuclear and own CGN Power, which plans to triple its generation over the next 15 years.

Outside of energy, they own China Mobile and China Unicom, which have massive cash reserves and offer an 8% dividend yield. Other holdings include Bayer, Polyus and Polymetal (two of the largest gold miners in the world). Overall, Russia and China are ~36% of the fund. Half the portfolio is in cash and gold until more exciting investment opportunities present themselves.

Longriver Podcast – Richard Lawrence

My friend Graham Rhodes spoke with Richard Lawrence about his new book “The Model” which explores the philosophies, practices and people that have driven Overlook’s success since it was founded in 1991.

Interview with Owen Hegarty

Wide-ranging conversation with Owen Hegarty, the chairman of EMR Capital. He was previously the founder of Oxiana Limited and, before that, spent 25 years with the Rio Tinto Group. You can access the full transcript here. He discusses his career and some notable transactions along the way (e.g. having bought and sold the Martabe gold mine three times).

He also talks about EMR’s involvement in metallurgical coal, in potash via Highfield Resources (listed on the ASX) and Peak Minerals (unlisted), as well as with 29Metals, an ASX-listed copper and base metals mining company where he serves as chairman.

Book – Value Investing: From Theory to Practice

Professor George Athanassakos, the Ben Graham Chair in Value Investing at Ivey Business School, has written an academic book on value investing that provides readers with an analytical process to find and buy stocks that trade significantly below intrinsic value. You can order a copy here if of interest. I haven’t read the book myself, but I did attend George’s annual value investing seminar back in 2010, and it was one of the best and most practical courses I have ever taken.

Movie – Lunana: A Yak in the Classroom

Bhutan is at the top of my travel list post-Covid and I was excited to learn about the reopening of the Trans Bhutan Trail for the first time in 60 years. Unfortunately, it might still be a while before a trip materializes, so I will instead enjoy the experience of being transported there via this film.