May turned out to be a strong month for stocks. I am not sure what to make of the swift recovery, but FT columnist Rob Armstrong coined the term ‘Taco trade’ (Trump Always Chickens Out) to explain recent investor conditioning. Amusingly, Trump was then asked about this by a journalist and he really did not like the question. So markets probably ought to worry about him not chickening out going forward, just to prove a point!

On a separate note, I came down with Covid-19 last week, following a short trip to HK. It certainly did not feel mild, although I am hopeful that the effects will not be as long lasting compared to the first time I got it a few years ago. I was also completely unaware of the most recent variant / wave of infections in several Asian countries. Although Covid-19 is now endemic, it is still advisable for certain segments of the population to take some precaution, especially those with underlying health conditions. Anyway, that is my PSA out of the way.

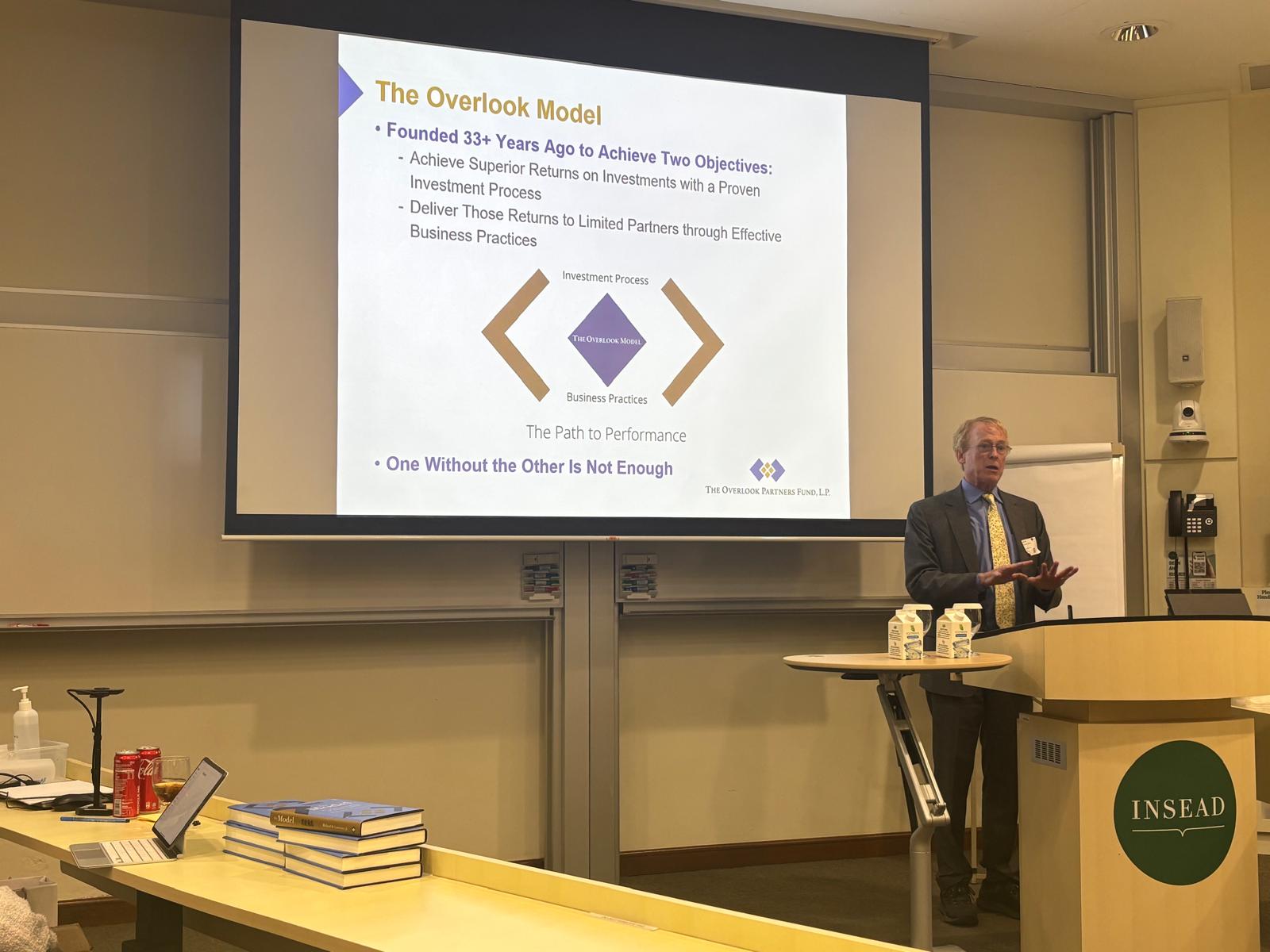

One personal highlight from the past month was seeing Richard Lawrence, the founder of Overlook Investments, speak at INSEAD in Singapore. My very first post on this blog (written nearly a decade ago now) covered a talk he gave at the Richard Ivey School of Business. At the time, there wasn’t much publicly available material on Overlook, but in the years since, he has written a very good book (The Model) and given a few more interviews. He is undoubtedly one of the best investors in Asia, but also a true role model for the industry (“outlaw the greed!”).

Jardine Matheson appoints Lincoln Pan as CEO.

Interesting appointment from Jardine, which is looking to evolve from its historical owner-operator model to being more of an “engaged, long-term investor.” Even prior to the CEO announcement, the company had added significant PE expertise to the board in the last 2 years (e.g., Janine Feng, Ming Lu). It isn’t yet clear what the new model will be, although an approach similar to some of the European family-controlled investment companies seems likely, versus a more deal-driven PE model. The intent to evolve seems real, although there is still a long way to go in terms of simplification of the corporate structure and the likely cultural adjustment required across such a large organisation.

As a brief aside, this is not the first external, banker/PE-type appointment to the CEO role at Jardine Matheson. Brian M. Powers was only ~38 years old when he was appointed taipan in 1988, although he had worked briefly within the company prior to assuming that role. The circumstances were rather different then, as he was initially brought on to help devise a restructuring of the group to make it less vulnerable to a hostile takeover (following the company’s struggles in the 1980s). He didn’t stay long in the role at Jardine, and eventually went on to run the private equity firm Hellman & Friedman.

Farewell fireside chat with David Webb, founder of Webb-site.com.

A rare, wide-ranging conversation with a man who has left an indelible mark on Hong Kong. For nearly 30 years, David Webb has been unwavering in his commitment to improving transparency, corporate governance and the rule of law. Investors in Hong Kong are much better off as a result of his efforts. In this final interview, he talks about his early life and career, why he decided to launch Webb-site, and some of his successful campaigns over the years (e.g., his work in 2017 on the ‘Enigma Network’ was a particular highlight in terms of exposing corporate malfeasance).

Sadly, with his cancer progressing, the time he has remaining is limited, but he shared his hopes for how others might take his work forward (he is making all the Webb-site datasets and software publicly available under a creative commons license). He signed off on a cautiously optimistic note regarding the future of Hong Kong and the “lion rock” spirit of its people. 加油!

Sir Chris Hohn (In Good Company Podcast).

Fantastic, long-form interview with one of the best investors of our time. Of particular interest to me were his comments on working with intuition, which he defines as “thinking without thinking.” A lot of people don’t understand what intuition is. It is a higher level of intelligence than just intellect. It doesn’t mean you just take things at face value. They still do the analysis, work etc. But it is when you just know something (experience, pattern recognition etc. might be part of it). He has worked with intuition more in the last 5-10 years, there has been a change. But he has always operated at an intuitive level, not just with stock picking. When he decided to start his own fund ~21 years ago, he had the intuition that he was in the wrong place and not doing what he was meant to do. Same when he met his wife, there is a point where you just know (this is the right person).

The podcast host, Nicolai Tangen, actually wrote his masters thesis on how fund managers use intuition in their decision making. You can download and read his research here.

Chris Wood on the end of US equity dominance (Money Maze Podcast).

Always a worthwhile listen, especially the way he is able to piece the macro together. His base case is that the US topped out as a share of the MSCI ACWI at the end of last year. The US reached a ~67% country weight in the index, despite being a much smaller share of the world economy, and even less in PPP terms. He thinks the dollar has now entered a long-term downtrend, in particular because the fiscal deterioration in the US post-pandemic “means that the most likely end game remains a growing resort to financial repression resulting in some form of yield curve control and even possibly exchange controls.” He sees Asian currencies as the most likely currency bloc to appreciate long-term against the dollar.

He also discusses his outlook for the bond market, private equity, bitcoin and gold (see some of my notes here from a similar interview with him earlier this year). His reference global long only equity portfolio is published in his Greed & Fear newsletter, but the gist of it is that he recommends investors increase their allocations to Indian, Chinese and European assets in order to rebalance their portfolios.

A few miscellaneous links to round off the reading list:

- FT: Is Japanese anime the next global IP gold mine?

- Bloomberg: Hedge funds tout Japanese tires, Hungarian drugs at Sohn HK.

- Meditation Capital: Q1 2025 letter.

- WNN: Trump sets out aim to quadruple US nuclear capacity.

- AFR: John Hempton says he will ‘make a lot of money’ once sell-off resumes.

Finally, friends of this blog are likely aware of my growing interest in the still nascent search fund industry in Asia. I have been keen to connect with more people in the ecosystem and potentially make some personal investments in the area. On this note, Asia Startup Network and Gen Capital Partners hosted an excellent weekend bootcamp on entrepreneurship through acquisition in Singapore a few weeks ago. I believe they will enroll more cohorts in the future, and I highly recommend the program to anyone who is exploring potential opportunities in the space. If any readers have similar inclinations re search funds, I would love to meet up and exchange ideas/notes.

I will sign off with a photo from my recent sojourn in Macau – footfall at the casinos was slow, the luxury shops were mostly empty, but the weather and the Portuguese food was fantastic!